2021, an exceptional year for the BioRegion

<p>The <a href="https://report.biocat.cat/">2021 BioRegion Report</a>, promoted by Biocat with CataloniaBio & HealthTech and ACCIÓ, shows the sector’s evolution in a year marked by efforts in health innovation, and with European and global challenges in its sights. </p>

“2021, an exceptional year.” This is the title of the introduction to the benchmark report for all those working in the life sciences and healthcare sector in Catalonia, based on the economic and innovation indicators from the Report’s four chapters. An exceptional time given the record impact on Catalonia’s wealth, accounting for 8.7% of the Catalan GDP and employing roughly 9% of the working population, plus a joint turnover of €37.7 billion (counting the industry and healthcare services). With an industry that exports over 50% of the products from Spain, a business fabric with over 1,300 companies and a growing startup segment that has, for the second year in a row, seen over €200 million in investment.

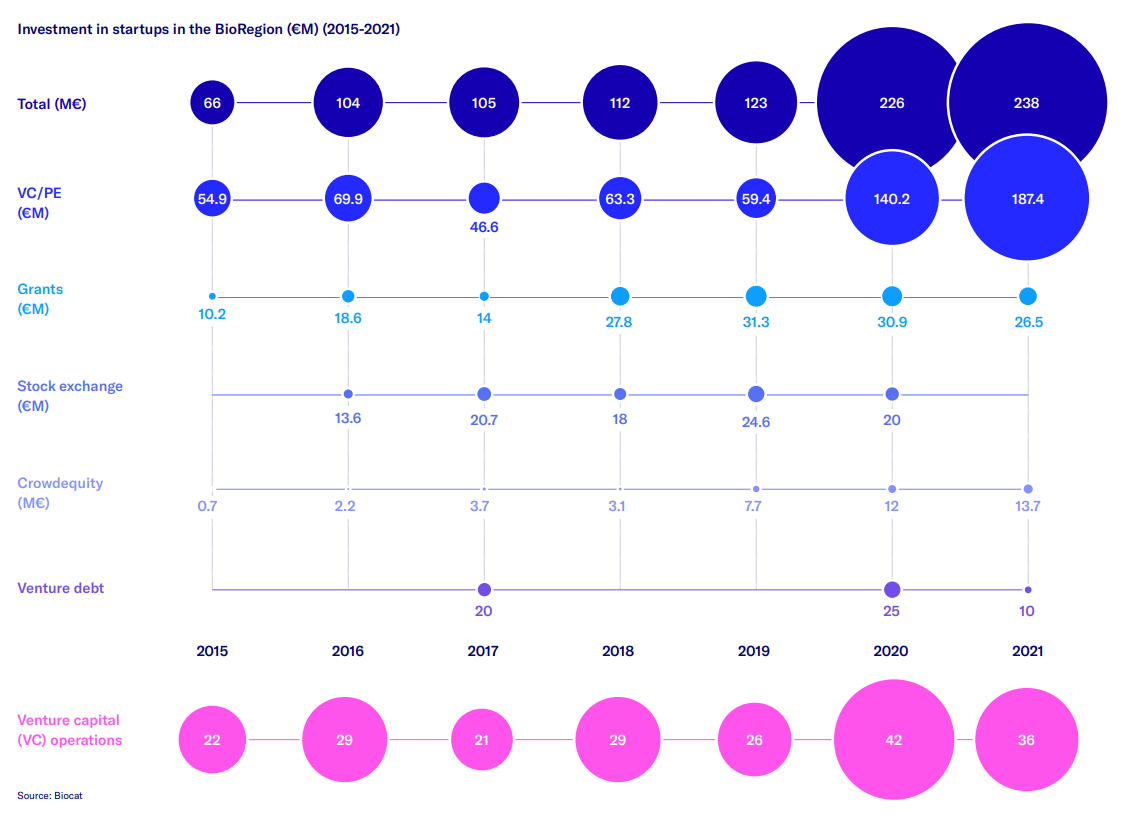

Specifically, investment totaled €238 million, the most to date, mainly from venture capital, which invested €187 million in 36 operations (34% more than in 2020 in fewer operations). As the graph shows, venture capital tripled from 2019 to 2021, driven by international participation in the operations, which was four times higher than that same year.

Two large rounds in dental health: coincidence or co-occurrence?

The two large venture capital operations in 2021 came in the medical technology subsector: Impress raised €41 million (the largest round in the history of the BioRegion) and Corus Dental raised €25 million. This subsector has seen the most noteworthy growth in investment, with 2.4 times more than the previous year. Will we continue to see figures like these? The answer isn’t surprising: Vladimir Lupenko, CEO and co-founder of Impress: “We’ll continue to see operations just as good as the ones we’ve had in 2021. In Catalonia, we have the pull of enviable companies and an environment that facilitates the creation of good startups.”

The fact that the two large rounds of 2021 were in dental health could have been a coincidence or co-occurrence. The key, according to Lupenko, was in knowing how to innovate in a traditional market. “Although this has always been a very traditional sector, companies like Impress have known how to innovate, attracting the attention of investors who believe dental health can go much further than what we’ve traditionally known,” he says. Lupenko believes the dental health market has a bright future and anticipates it will become even more attractive to investors. “It’s a sector that affects the whole global population and companies that innovate in such a traditional market open up a wide range of possibilities,” he predicts.

Behind these two large operations, there were seven others that stood out with more than €10 million: InBrain Neuroelectronics (€14.3 million), Koa Health (€14 million), IMIDomics (€14 million), Mediktor (€11 million), TopDoctors (€11 million), VEnvirotech (€11 million) and Anaconda Biomed (€10 million).

As we noted previously, the role international funds played in these and most venture capital operations was, once again, decisive: 83% of the capital raised was in operations that included international investors. In fact, more than 90% of operations over €10 million were syndicated with international investors, which is above the European average. The solid network of specialized investors established in Barcelona is essential to attracting attention to local projects, but the quality of companies also plays an important role. "Startups must be attractive. They must have a strong component of innovation and differentiation, a fact that already exists in the BioRegion," said Joël Jean-Mairet, Managing Partner at Ysios Capital, who said that the relationship with international operators has strengthened over the years and admits the BioRegion has consolidated itself as a European hub to consider.

Growth in digital health and diversity in deeptech

The two years of the pandemic have been key to accelerating the digitalization of the healthcare sector and healthcare services, as well as fueling the growth of digital health startups, which haven’t stopped growing in number since 2017 and in 2021 saw nearly twice as much investment as the previous year with more than €60 million.

The big star in this segment was Koa Health, a spinoff of Telefònica that offers digital solutions for mental wellbeing, closing the largest round of investment in digital health in the history of the BioRegion and Spain after attracting €30 million (divided between 2020 and 2021). According to the company’s Chief Digital Therapeutics Officer Stephen Dunne, the impact of the pandemic is clear: “COVID-19 not only boosted investor attraction in a tumultuous time but also accelerated the progress of our project,” he explains. Dunne remembers how everything came to a head in just a few days: “At the outbreak of the pandemic, we were doing clinical trials and, suddenly, our solution was being implemented in hospitals. Everyone wanted to be part of it!”

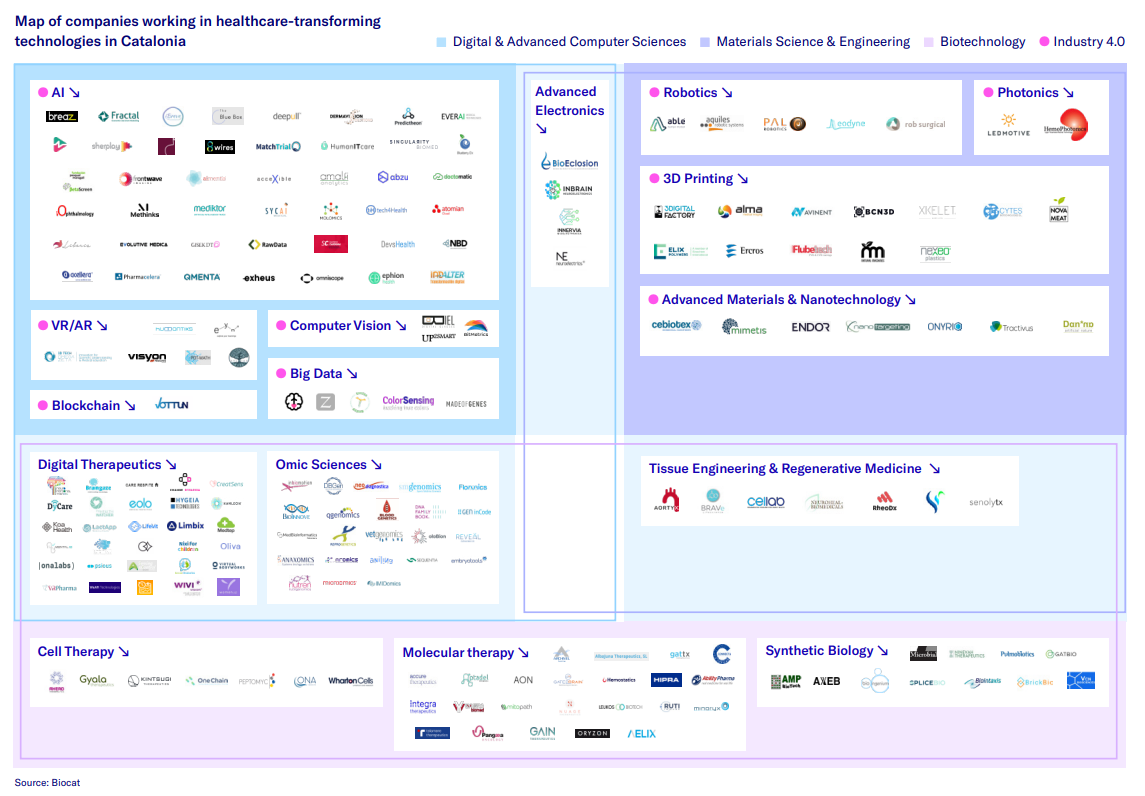

The digital health map presented in the 2021 Report, with over 200 startups working in this field, raises awareness of the good number of companies working in telemedicine, support for medical decision-making, health apps, and also digital therapies (DTx), a category that now has 30 companies and is expected to grow over the coming years.

This segment is also included on a new map in the 2021 Report: deeptech companies working in new technology like artificial intelligence (AI), omics, 3D printing and virtual reality (VR) that facilitates analysis and interpretation of big data, restoration of cell functions, training of healthcare professionals and the creation of artificial tissues and organs, among others. Altogether, this will have a significant impact on how healthcare is provided and, therefore, on making the population healthier.

GoodGut and HIPRA: a case of successful technology transfer made in Catalonia

2021 also had significant M&A operations, with 6 local businesses acquired by other companies, mainly from the US. Noteworthy among these was GoodGut, a spinoff of UdG and IDIBGI that was acquired by Catalan multinational pharmaceutical corporation HIPRA, which has been in the news during the pandemic for its recombinant protein vaccine that is soon moving into phase III.

GoodGut is a good example of the technology transfer between large corporations and startups that we’ve seen recently in the BioRegion. There are still few emerging companies that manage to expand and consolidate their project through mergers and acquisitions, but GoodGut co-founder and CEO Mariona Serra believes “this alliance is a success for the biotechnology sector and an indicator of the maturity of the Catalan entrepreneurial ecosystem.”, in addition to forecasting an increase in acquisitions in the coming years. "We are in a time of constant technological change, and the incorporation of innovation into large companies represents a great risk and investment. Startups have become a key mechanism for introducing innovation to companies. " But he warns: "For this acquisition to be effective, the startup must have a good science and technology base, but also an industrial product orientation and be scalable for rapid implementation.

Despite being optimistic, the entrepreneur acknowledges that there are still challenges to be met for more cases such as GoodGut: meeting between large companies and startups, and these receive little help for their implementation phase. For their part, large companies are unfamiliar with the process of innovating through the acquisition of startups, so more examples are needed for more cases to be made, ”he explains.

Therapies advancing towards patients in the BioRegion pipeline

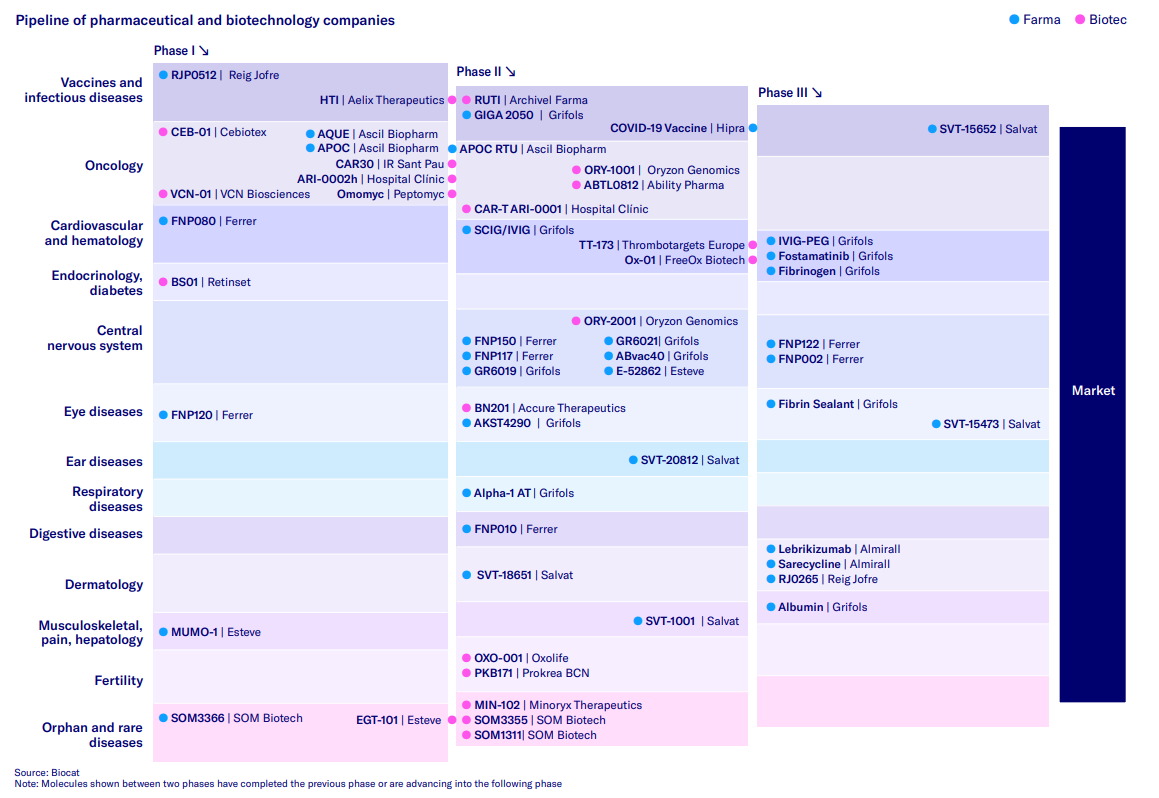

An overview of the 56 therapies being developed in the BioRegion gives us a snapshot of R&D priorities in certain clinical areas and the timeline for some therapies to reach the market and have an impact on patients’ health.

As the chart shows, the main areas of research the industry and startups focus on are oncology, hematology, dermatology, the central nervous system and infectious diseases, some of which are already in phase IIb and III. Biotech companies like Ability Pharma (pancreatic cancer), Mynorix Therapeutics (orphan and rare diseases), Oxolife (female fertility) and Peptomyc (tumors) advanced in or announced news on their trials in 2021, and others like Archivel Farma, HIPRA and Grifols stood out for their advances in the fight against COVID-19.

This post looks at just a few of the economic and innovation indicators laid out in the 2021 Report, which once again this year was made possible by the collaboration of AMGEN, and was drafted with CataloniaBio & Healthtech and ACCIÓ, with support from Alira Health, EATRIS, EY and PONS IP. If you would like to learn more about the interesting conclusions drawn from other aspects of the sector and other qualitative insights on business activity, get all the information here.