The digital health boom in Barcelona: a growing ecosystem

<p>The BioRegion has seen a substantial growth of digital health companies in the last ten years, as well as a significant increase in the investment received. We give you the figures and the keys of the transformation of this sector into a vibrant ecosystem.</p>

Despite there are many definitions of digital health and it is hard to find consensus between the different organizations and professionals in the sector, the European Commission defines digital health as the tools and services that use information and communication technologies (ICTs) to improve prevention, diagnosis, treatment, monitoring and management of health-related issues and to monitor and manage lifestyle-habits that impact health. The Digital Therapeutics Alliance (DTx) goes beyond this definition and differentiates between digital health, digital medicine and digital therapeutics depending on the clinical evidence, the regulatory frame and the product type, highlighting the rapid evolution of this subsector.

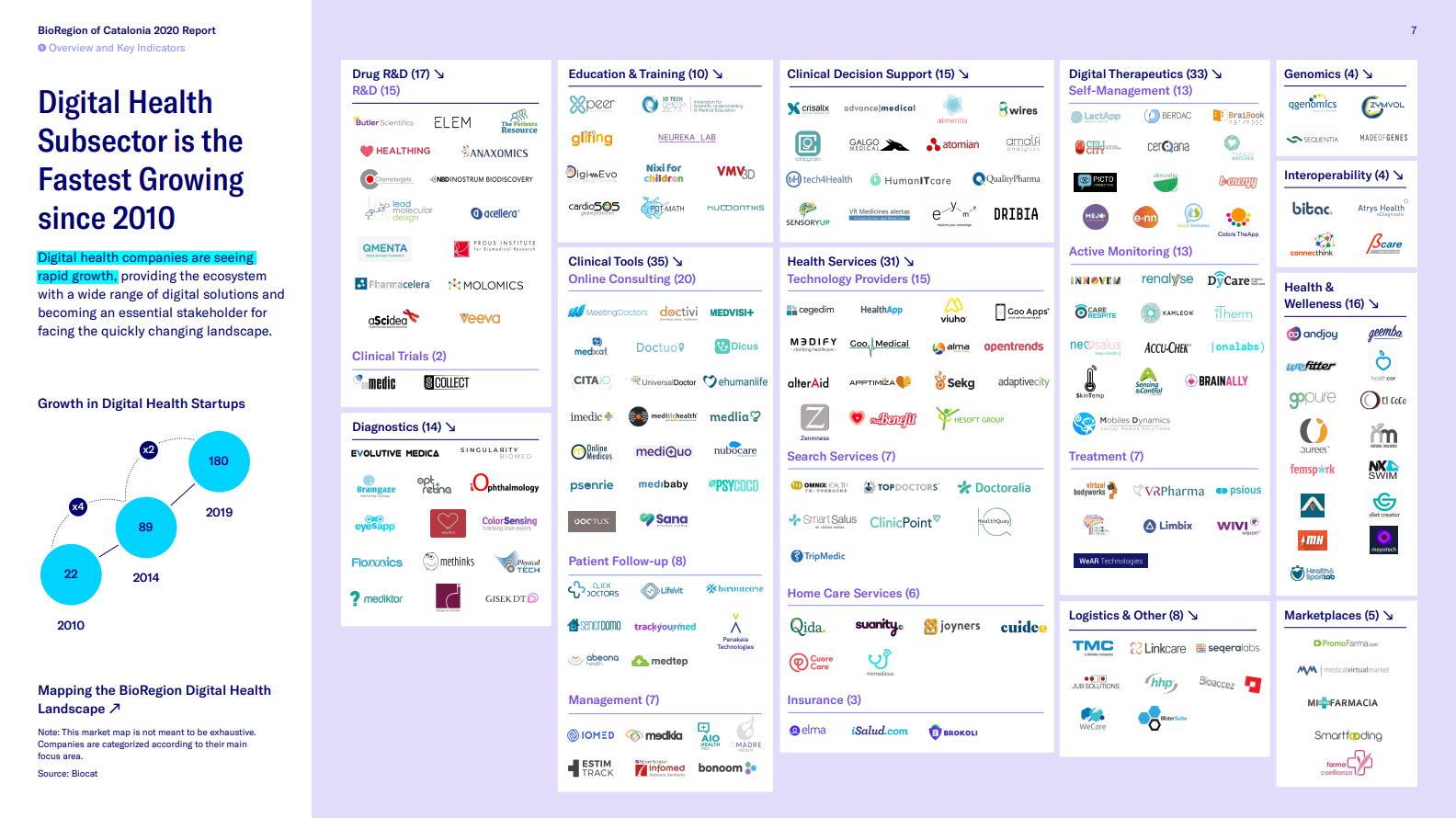

The BioRegion has seen significant growth in companies that fall into this subsector over the past ten years, as well as the amount invested here, as can be seen in the 2020 BioRegion Report presented in September. While in 2010 there were only about 20 companies, 10 years later there are over 200: or a tenfold increase in number of companies. Investment in these companies has tripled in recent years, from €5.1 million in 2016 to €18.8 million in 2019, according to the report.

This growth reveals the subsector’s youth, which is 90% startups and has a joint turnover of €118 million. So, the average company is young, with under five years in the business, and no more than 10 employees. One important figure: 21% of these firms were founded and are led by women.

Although the majority of the digital health map is made up of microenterprises, it also includes some medium and large companies, including Doctoralia, created in 2007, which is one of the clearest success stories in the sector: 13 years later it has 225 on staff and it merged with DocPlanner in 2016. The Catalan capital is also home to the global headquarters of one of the world leaders in telemedicine, Teladoc Health, established in the city in 2018 through the acquisition of Advance Medical, company founded by Carlos Nueno and Marc Subirats in 1999. Today, Teladoc Health employs 1,300 professionals in Barcelona.

A good number of digital health companies are located and promoted from the technology hubs that have popped up in the city in recent years: Barcelona Tech City (2013), with over 1,000 technology-based companies, and Barcelona Health Hub (2018), which brings together 225 companies and organizations exclusively from the healthcare sector.

The main services or products these companies offer are: clinical tools, with most companies focusing on telemedicine (like Doctivi, Mediquo, etc.), monitoring patients (LifeVit) or managing data (IOMED); and healthcare services, which includes technology suppliers like Apptimiza, search engines to find medical professionals (like Doctoralia), home care services (like Cuideo and Joyners) and insurance brokers (like Elma, iSalud and Brokoli). Other powerful companies in the sector offer drug development using digital tools, like Chemotargets, Pharmacelera and ELEM; diagnostic services, like consolidated Mediktor and promising up-and-comer MeThinks; clinical decision-making tools, like HumanITCare and Amalfi Analytics; digital therapeutics, like Koa Health (a spinout of Telefónica based in Barcelona), Psious, Limbix and Social Diabetes; genomics services (Made of Genes and Sequentia), interoperability (Bitac, AtrysHealth, etc.), health and wellness and marketplaces.

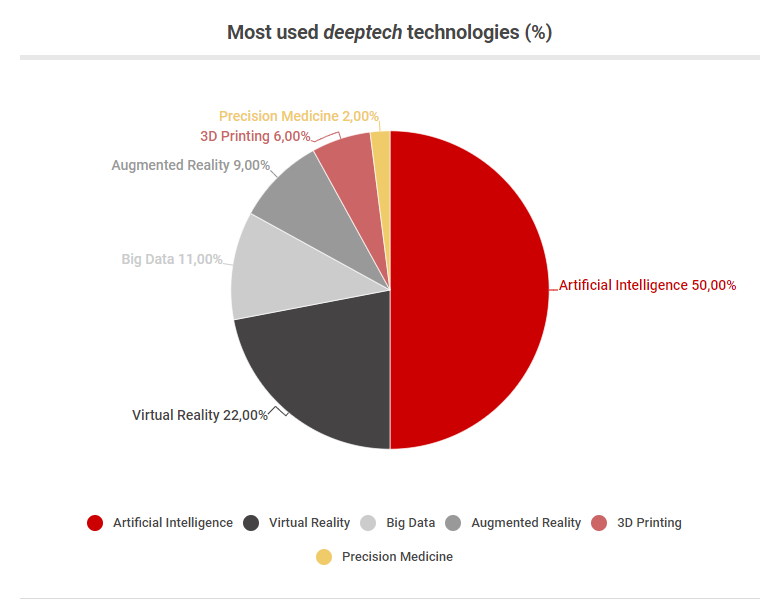

The technologies most used by these companies are artificial intelligence (with applications such as machine learning and deep learning), virtual reality, big data, augmented reality and 3D printing. One in four digital health companies from the BioRegion use some of these technologies.

Crescendo of investment and acquisitions

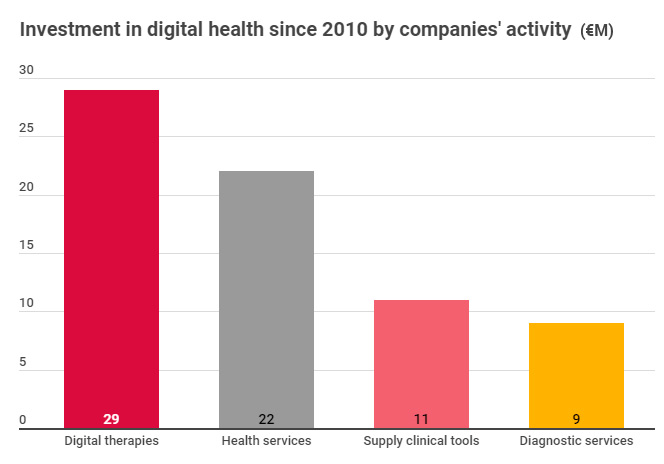

The data from the BioRegion Report shows that digital health companies have raised over €18 million in 2020. If we add the investment raised in the past two months, the total for the year is nearing €33 million, with significant rounds by Koa Health (€14M) and MeThinks (€1.8M). In general, the most noteworthy rounds have been achieved by Psious (8M€), Elma (€6.1M), Linkcare (€5M), Qida (€3.6M), Top Doctors (€3M), Mediktor (€3M) and Mediquo (€3M).

We can see in this figure the digital health areas in which investors have shown the most interest since 2010 in the BioRegion.

Despite being a young sector that is still growing, we’ve seen some of the first success stories, with companies born in the BioRegion being acquired by international groups or companies. Some examples include Advance Medical, acquired by Teladoc for €301 million (2018); PromoFarma, acquired by Zur Rose Group (2018), and iSalud, acquired by CNP Partners for €30 million (2018).

The keys of a vibrant ecosystem

Biocat has spoken with several key figures in the BioRegion’s digital health ecosystem, who gave their view on and outlook for the future of the sector. Miquel Martí, CEO of Barcelona Tech City, believes that “the positive moment the city is experiencing in terms of healthcare innovation is thanks to the good research in the ecosystem, which in previous years has led to the creation of important science-based spinoffs. The commitment of large corporations like Roche, Novartis, Ferrer, Almirall, etc. has also played a very important role in consolidating the ecosystem. The sector is growing, with more and more investors in the healthcare sector. All together, this makes it possible to apply innovation to products and services, and to modernize the healthcare system. A few years ago, e-commerce was the sector that made Barcelona a technology hub; over the coming years, it will be healthcare innovation.”

Barcelona Tech City expects to open a new space next year in the area around Pier01 (in Palau de Mar) where it will prioritize a healthcare hub featuring stakeholders from the sector, Martí told Biocat.

Frederic Llordachs, one of the three founders of Doctoralia and founder of Doctivi and Braincats, has experienced the transformation of the ecosystem from an entrepreneur’s point of view: “In 2007, when we founded Doctoralia, some people laughed at me because I did things online. Now we have a well-organized ecosystem and entrepreneurs are respected.” The main difficulty, Llordachs explains, is that “us startups are practically running on empty. We have to reach short/middle-term profitability if we want to survive, and that is only possible through billing, not grants... Digital health companies need to be profitable in the short/middle term. It isn’t like the biotech sector, where you start seeing returns after 10 years.”

Another factor that has also had an impact on the ecosystem is the international conferences and congresses held in Barcelona. HIMSS, a non-profit organization that promotes digitalization in the healthcare sector, held their yearly European congress in the city from 2016 to 2018. Pascal Lardier, vice-president of International Events & Media Content for the organization, believes that “Barcelona has clearly committed to building a true digital health ecosystem. There have been a series of measures to help encourage stakeholders in the sector to adopt innovation. In short, Barcelona is one of Europe’s digital health hubs, alongside Berlin and Helsinki.”

Aline Noizet, Chief International Officer at Barcelona Health Hub and a recognised expert in digital health having worked in cities like Berlin and New York, explains that the BioRegion ecosystem “has grown at the same time as Barcelona has consolidated its place as a benchmark city in technology. That’s why there are now more investment funds investing in health, although it is still complicated to get series B funding.” The city’s attractive climate and culture draw talent here, she says, and that means companies can find professionals who specialize in fields like big data and artificial intelligence. Some also highlighted hurdles to overcome: the lack of opportunities for startups to do pilot testing on their innovations within the healthcare system, and the Spanish legal framework, which makes it difficult to implement services like telemedicine or medical apps, unlike other countries like Germany.

Challenges ahead

Marta-Gaia Zanchi, founder and CEO of Nina Capital, a Barcelona-based investment fund that specializes in digital health, notes several factors that impede more solid growth of the ecosystem: “very penalizing taxation and unfavorable, opaque equity and stock options rules. To launch a company requires a disproportionate effort and significant startup capital,” she explains. Plus, “fewer companies receive further financing from the same investors, even when they do very well. Also, corporate and government are larger contributors to startup capital, but these are traditionally not repeat investors either.” Gaia explains that this means startups are “more likely to survive operating with low burn rate at a small profit, gaining some market penetration in the national market alone,” but don’t expand any further.

For his part, Biocat CEO Jordi Naval, who has experience in biotech start-ups, notes other challenges the ecosystem is facing that must be overcome in order to consolidate this subsector in the BioRegion:

- Clinical validation of innovations

- Optimizing artificial intelligence techniques

- Adopting innovation in the healthcare system

- Monetizing and business model of digital health products

Our next article on digital health will focus on these topics. If you’re part of the sector, we invite you to write to us with your take on the obstacles you think we need to overcome, and how this can be done, in order to consolidate the digital health ecosystem in the BioRegion.