International investment in the BioRegion: a long-distance race

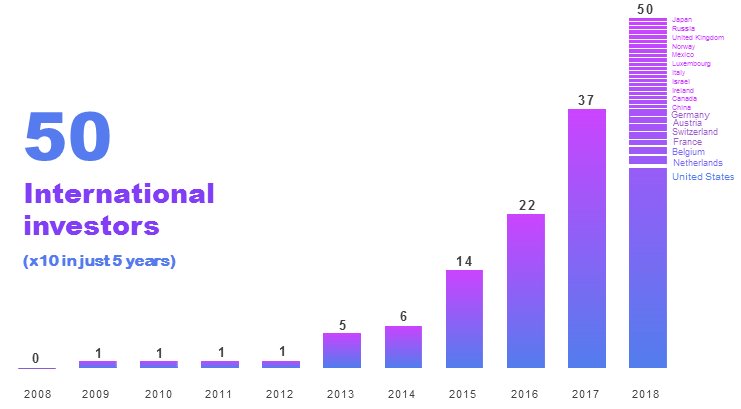

<p>The amount of foreign venture capital being invested in the BioRegion of Catalonia has grown steadily in recent years. It increased ten-fold between 2013 and 2018, going from 5 to 50 in just 5 years. Who is investing in start-ups in the Catalan healthcare and life sciences sector and where are they doing it?</p>

MIT says that funding is one of the five dimensions needed to boost the innovation and entrepreneurship capacities of an ecosystem, as it provides support from the very start (concept) throughout its journey to impact (from start-up through scale-up). This approach is clearly visible in the 5 most famous ecosystems in the world in the world (Silicon Valley, NY, Boston, London and Beijing), where the quality of investors and access to investment have been key to development.

Barcelona is starting to move up the ranks in this race of global ecosystems, becoming one of the main innovation hubs in Europe not only in terms of multinational corporations, talent, knowledge and start-ups, but also in attracting international capital.

The healthcare and life sciences sector is an example of this sprint, where foreign venture capital has injected more than €150 million in our start-ups over the past 5 years (2013-2018). In fact, more than half of all the raised capital included international investors, or almost 70% if we look only at the ones from last year. The presence of up to 50 international capital firms (with at least 10 new ones popping up in 2016) positions Barcelona to become one of the most powerful magnets for investment in the coming years.

Where do these investors come from and what are they risking? How is this growth expected to evolve?

Let’s start with the why: what has been the reason for this growth? One of the main leveraging factors in attracting international capital to the BioRegion has undoubtedly been the role played by specialized local funds, which along with top-notch research and entrepreneurial talent, have become a key indicator. It just takes a glance at the funds participating in the most important rounds over the past three years: 100% have included a local investor. Ysios was the first and most visionary specialized fund, diversifying its operations locally and abroad, forging relationships with foreign venture capital funds that would later become their partners on the ground. Caixa Capital Risc, Alta LIfe Sciences and Inveready have also contributed to expanding this network, and soon Assabys, Nina Capital and InvivoVentures will do the same. There are not-to-be-missed events like JP Morgan in San Francisco, but also ones in Europe, like BioEurope, 4YFN, Health 2.0 and BioEquity, held for the first time in Barcelona this May.

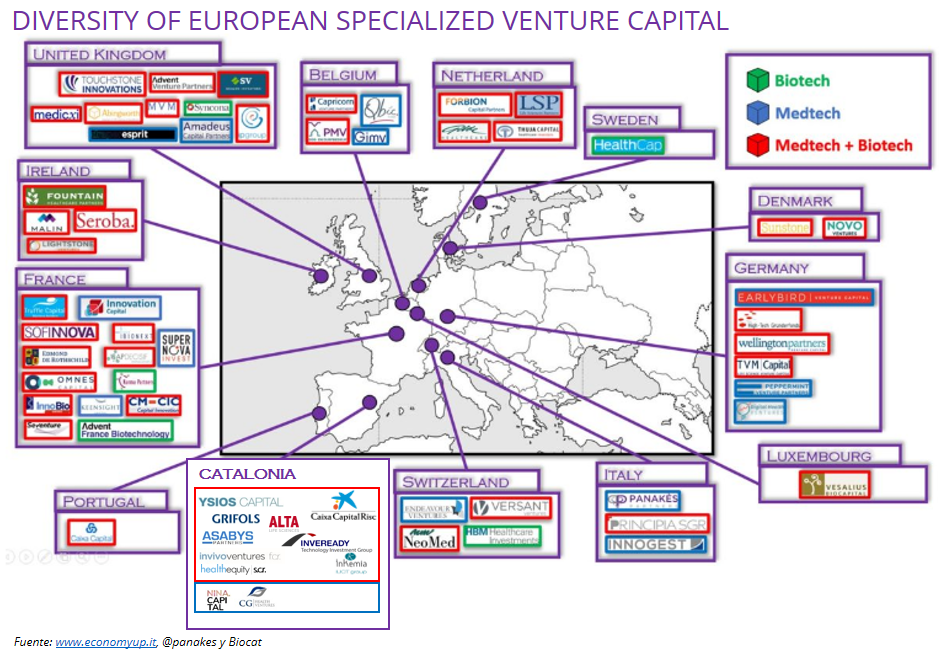

And where does the capital come from? The study of investors and projects receiving investment 2013-2018 doesn’t show a stable pattern, but there are some points of note:

- The majority of the funds (18) are from the US. Anaconda, Minoryx and Oryzon are the companies that have attracted the majority of their capital, but they also invested in 10 smaller rounds (between €500,000 and €4 million).

- Nevertheless, the Series A and B rounds in recent years (Abac Therapeutics, Anaconda, STAT-Dx and Minoryx) have mainly featured European funds. The investment from each fund individually isn’t public knowledge but looking just at these operations (between €10 million and €30 million) and the number of investors in each round (between 5 and 11), we can guess that the average ticket per investor is between €2 million and €5 million.

- Ysios and Caixa Capital Risc are the local funds that have accompanied the most international operations (9). There are also investors that have done so on their own (10), but in slightly lower amounts (€500,000 to €3 million).

- So far, 2 of the 50 (Kurma Parners and Idinvest Partners) have invested in different start-ups: specifically, in the two most important rounds in these five years (STAT-Dx and Minoryx). We believe this trend will continue, as once they have seen the excellence of the science and effective execution of the projects, investors prefer to invest where they feel comfortable, in second, third and later rounds.

- The interest of international capital is well distributed: from biotech firms like Oryzon and Minoryx, to medical technology companies like STAT-Dx and Anaconda, and healthtech businesses like Mediktor and Linkcare. The bulk of the investment goes to biotech and medtech companies (given the needs of the business), but the current rate of growth in digital health firms (42% in 2018) and the technological transformation of the sector will narrow this gap quickly.

- The presence of corporate ventures looking to incorporate innovation and products into their portfolios is also growing, making up 10% of all participation (Boehringer Ingelheim Venture Fund, Chiesi Ventures, Johnson&Johnson Innovation, Roche Venture Fund and Siemens Venture Capital, for example).

Will this trend continue in the coming years?

The increase in investment in recent years (healthcare start-ups in the US raised more venture capital in 2018 than any of the 10 previous years and, in Europe, investment in biotech firms has grown 28%) indicates that investors’ commitment to the sector will continue. The rounds are getting bigger and bigger (outside of Catalonia, we are starting to see series C rounds and there are now up to 30 healthcare unicorns), there are more and more start-ups (a new company is started each week in the BioRegion of Catalonia), there is a growing number of M&As and non-specialized investors. In fact, the increase and frequency in US investment in the BioRegion coincides with the growing venture capital boom that started in the US in 2013, where +200 investment funds have been created on average each year. Europe is another dimension, with less capital available and other limiting factors (the average size of a European fund is half an American one and the number of deals and IPOs is much lower): so, attracting US or Asian funds is always highly interesting.

Biocat estimates that start-ups in the BioRegion of Catalonia will be raising roughly €500 million a year in funding by 2025, most from foreign sources. We’ve gone from 5 to 50 international investors in just 5 years. What will happen to this number over the coming years? We don’t know. But we do know that investing in the BioRegion of Catalonia is yielding positive results: in fact, 2018 came to a close with two significant exits (STAT-Dx and Advance Medical).

We hope many more opportunities pop up over the coming years to help get the most important return on investment: developing medical treatments that improve people’s lives.